Xinyi Glass Announces 2021 Annual Results

Delivers Brilliant Performance Net Profit Exceeds HK$10 Billion

Revenue, Gross Profit and Net Profit Again Hit Record High

* * *

Maintains High Dividend Payout Ratio

HK142.0 Cents per Share for the Year

Summary

(Hong Kong, 28 February 2022) – Xinyi Glass Holdings Limited (“Xinyi Glass” or the “Group”) (stock code: 00868.hk), a leading integrated automobile glass, energy-saving architectural glass and high-quality float glass manufacturer, today announced its annual results for the year ended 31 December 2021 (“FY 2021”).

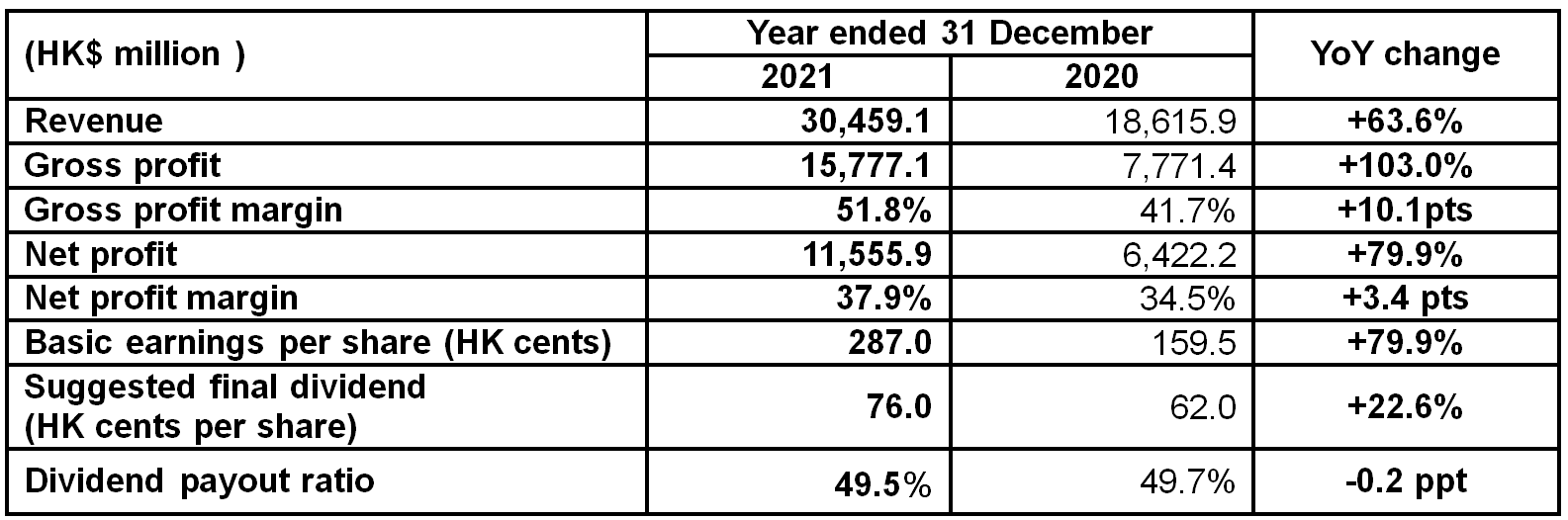

During the year under review, Xinyi Glass continued to maintain its leading position in the glass industry. Its core businesses performed well, with revenue, gross profit and net profit all hitting new high. Revenue increased by 63.6% to HK$30,459.1 million (2020: HK$18,615.9 million). Gross profit was HK$15,777.1 million (2020: HK$7,771.4 million), up 103.0% against the previous year, with gross profit margin widened by a notable 10.1 percentage points to 51.8% (2020: 41.7%). Thanks to the strong sales growth of float glass, automobile glass and architectural glass, and the resilient average sales price of float glass plus effective cost control, net profit of the Group for the year increased by 79.9% to HK$11,555.9 million (2020: HK$6,422.2 million), net profit margin increased by 3.4 percentage points to 37.9% (2020: 34.5%). Basic earnings per share were HK 287.0 cents (2020: HK 159.5 cents).

The Group's financial status remained sound. As at 31 December 2021, the Group had cash on hand of HK$10,295.1 million (31 December 2020: HK$5,304.1 million). The Board of Directors recommended payment of a final dividend of HK76.0 cents per share. Together with the interim dividend of HK66.0 cents already paid, total dividend for the year amounted to HK142.0 cents, representing a dividend payout ratio of 49.5%.

Dr. LEE Yin Yee, BBS, Chairman of Xinyi Glass, said, “In 2021, with the pandemic gradually brought under control, the global economy showed signs of recovery. As the central government implementing strict anti-epidemic restrictions and vaccination policy, the Chinese economy rebounded notably during the year. The mainland real estate market particularly heated up in the first half year, which translated into strong float glass demand in the construction industry, and our float glass and architectural glass business and product prices both climbed. The Group was able to maintain strong profitability, pushing its overall operating performance to record high. We are very optimistic about the prospects of the industry at large and the Group, and are confident of maintaining the growth momentum and bring long-term sustainable returns to shareholders."

Business Review

Float glass – Gross profit increased significantly thanks to strong demand

Benefiting from strong demand and increase in the Group’s production capacity, the Group’s float glass business grew strongly, with revenue up by approximately 85.7% to HK$21,907.5 million. Gross profit rose by 154.6% to HK$11,776.2 million against the previous year, and gross profit margin also surged to 53.8% (2020: 39.2%). Although the average unit price of float glass softened in the second half of 2021, the overall average market price was still more than 45% higher than that in the previous year. The release of demand plus stable supply supported the product price after its adjustment. In February 2022, float glass price was already markedly higher than that in the same period last year and is expected to continue to trend up, thus the Group remains optimistic about development of the business.

Automobile glass – Robust demand in overseas markets bolstered sales volume

The pandemic easing and quarantine measures relaxing have boosted overseas demand for automobile glass. During the year, the Group’s automobile glass business performed well, with revenue up 18.4% year-on-year to HK$5,457.0 million, gross profit rose by 18.1% to HK$2,571.4 million and gross profit margin at 47.1%. The business segment has maintained its gross profit margin at 45% for a long time, serving as a benchmark for the industry. Global automobile penetration rate is rising, and new cars are designed with larger windows, such as panoramic sunroof, which will stimulate glass use in the long run. The business segment thus has ample room for growth and will be a solid growth driver of the Group.

Architectural glass – Benefitting from recovery of construction industry demand and favorable policy expected to brace bright future

The Group’s architectural glass business performed brilliantly with revenue up 39.9% year-on-year to HK$3,094.6 million, gross profit surged by 47.4% to HK$1,429.5 million, and gross profit margin increased from 43.9% to 46.2%. Steady economic recovery has seen construction activities grow. In addition, the central government has expanded supply of affordable housing. All those plus the drive from national environmental policies, more construction projects are using energy-saving, sound-proof and high-value-added architectural glass products, and that has stimulated demand for single insulating, double insulating (triple layers) and laminated insulating (triple layers) glass products. The performance of architectural glass business has room for growth.

Geographic Market Analysis

During the year, the Greater China region remained the Group’s largest geographical market, with revenue increased by 73.8% year-on-year to HK$23,700.0 million, accounting for 77.8% of the Group’s total revenue. As for overseas markets, revenue from North America, Europe and other regions all recorded satisfactory growth, with the total amounted to HK$6,759.1 million. Overseas markets accounted for 22.2% of the Group’s total revenue.

Prospects

Looking at the year ahead, prices of upstream raw materials such as soda ash will stabilize, and the Group is hopeful of keeping production costs steady considering its own silica sand mines can provide a certain amount of silica sand. With demand to complete projects remaining unchanged and aged production lines starting cold repair, the float glass supply and demand structure in the industry is expected to keep optimizing. Looking forward, the Group will continue to deepen product differentiation, add high-end products to develop a diversified product portfolio, and consolidate its leading position in the industry.

The Group is speeding up increase in production capacity. In the second half of 2021, it completed procurement of four float glass production lines, with daily melting capacity reaching 2,400 tonnes, in Chengmai County, Hainan Province. Its total annual float glass production capacity had increased from 6.35 million tonnes in 2020 to 8.20 million tonnes in 2021. The Group will continue to actively implement expansion strategy and raise the production capacity of its existing strategically-located industrial parks, to give it greater flexibility in production planning for capturing a greater market share.

In December 2021, the Group announced the establishment of Xinyi Silicon, a joint venture with Xinyi Solar, to pursue Polysilicon production projects, which will facilitate horizontal expansion of Xinyi Group, while seizing the huge market opportunities brought by rising solar energy demand, and become another revenue driver of the Group apart from overseas glass projects.

Dr. LEE concluded, “In its 30-plus-years history, the Group has seen opportunities and rode out difficulties. We have always adhered to our beliefs in and strategy of being active and innovative and keeping our feet on ground, which has enabled us to develop on steady strides and continually achieve breakthroughs. In 2021, Xinyi Glass officially became a 'blue chip' in the Hang Seng Index, which is another milestone made by the Group on its journey into the global capital market, telling of the high recognition it enjoys from the capital market for its business foundation, financial performance and long-term investment value. Looking forward, we will continue to expand business, press on with raising our production capacity and enlarge our market share in good order to reward shareholders for their support over the years."

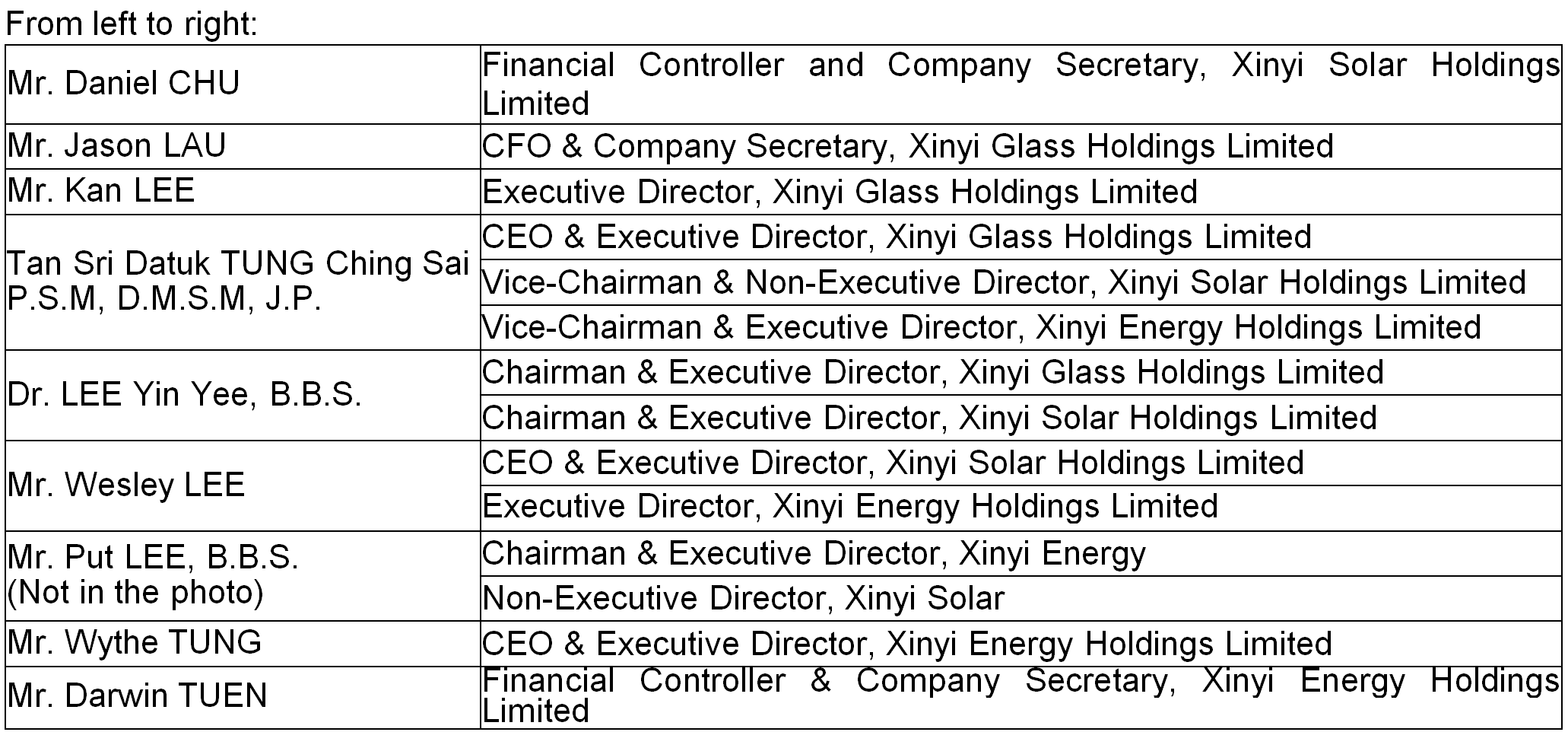

Photo Caption